Jupiter Solana Exchange: The Ultimate Guide to Solana’s Leading DEX Aggregator

Jupiter Exchange is a cornerstone of decentralized finance (DeFi) on the Solana blockchain, redefining how users trade cryptocurrencies with its advanced decentralized exchange (DEX) aggregator. By leveraging Solana’s high-speed, low-cost infrastructure, Jupiter delivers seamless, cost-effective token swaps with minimal slippage, making it a go-to platform for traders and DeFi enthusiasts. In this comprehensive guide, we’ll explore Jupiter’s features, its role in the Solana ecosystem, and why it stands out as a leader in DeFi innovation.

What is Jupiter Exchange?

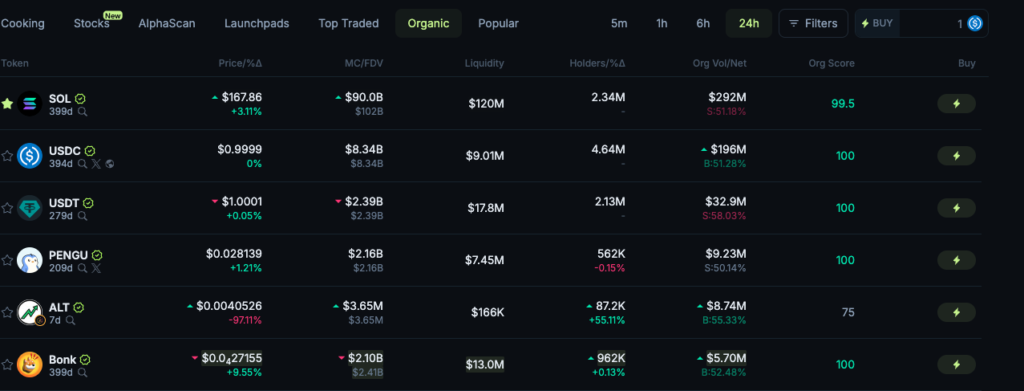

Jupiter Exchange is a DEX aggregator built on the Solana blockchain, designed to optimize token swaps by sourcing liquidity from multiple decentralized exchanges (DEXs) and automated market makers (AMMs) like Raydium, Orca, and Serum. Unlike traditional exchanges, Jupiter doesn’t rely on a single liquidity pool. Instead, it uses a smart routing algorithm to find the best trade routes, ensuring users get the most competitive prices with minimal fees and slippage. Launched in September 2021, Jupiter has grown into Solana’s largest DEX aggregator, commanding over 95% of DEX aggregator volume and processing daily trades worth hundreds of millions of dollars.

Why Jupiter Matters in DeFi

Jupiter’s rise to prominence stems from its ability to address key pain points in DeFi trading: high fees, slippage, and fragmented liquidity. By aggregating liquidity from over 20 DEXs on Solana, Jupiter ensures traders can execute swaps efficiently, even for large transactions. Its integration of advanced features like limit orders, dollar-cost averaging (DCA), and perpetual futures makes it a versatile platform for both novice and experienced traders. Additionally, Jupiter’s governance token, JUP, empowers users to shape the platform’s future, fostering a community-driven approach to DeFi innovation.

Key Features of Jupiter Exchange

Jupiter Exchange offers a suite of tools that set it apart from other DEX aggregators. Below, we dive into its standout features, optimized for user experience and trading efficiency.

1. Smart Trade Routing

Jupiter’s smart routing algorithm is the backbone of its efficiency. When a user initiates a swap, Jupiter scans multiple DEXs and liquidity pools to identify the optimal trade route. For example, instead of a direct USDC-to-SOL swap, Jupiter might route through an intermediary token like mSOL if it offers better pricing. This process, known as trade splitting, breaks large trades into smaller chunks across multiple pools to minimize price impact and slippage. The result is a seamless trading experience with maximized returns.

2. Limit Orders

Unlike many DEXs that rely solely on automated market makers, Jupiter offers limit orders, allowing users to set specific price conditions for their trades. This feature is particularly valuable during volatile market conditions, as it eliminates the risk of slippage and ensures trades execute only when desired price levels are met. Limit orders bridge the gap between centralized and decentralized exchanges, making Jupiter accessible to traders accustomed to traditional platforms.

3. Dollar-Cost Averaging (DCA)

Jupiter’s DCA feature enables users to automate periodic token purchases, reducing the impact of market volatility. By spreading investments over time, users can mitigate the risk of buying at peak prices. This feature is ideal for long-term investors looking to build positions in Solana-based assets without constantly monitoring the market.

4. Perpetual Futures

Jupiter supports perpetual futures trading, allowing users to speculate on asset prices with leverage. This feature caters to advanced traders seeking to amplify their exposure to Solana’s ecosystem tokens. However, perpetuals carry higher risks, and users are advised to approach them with caution and thorough research.

5. Lending and Borrowing

Jupiter’s Lend feature, introduced recently, allows users to lend and borrow Solana-based assets directly on the platform. This enhances liquidity within the ecosystem and enables users to earn interest on idle assets or access liquidity without selling their holdings. The lending feature positions Jupiter as a competitor in the DeFi lending space, further solidifying its role as a multi-functional platform.

6. Bridge Comparator

Jupiter’s Bridge Comparator tool simplifies cross-chain transactions by comparing routes and fees for transferring assets between Solana and other blockchains. This feature enhances interoperability, making it easier for users to move assets seamlessly across networks.

7. JupSOL: Staking and Yield Opportunities

Jupiter’s JupSOL is a liquid staking token (LST) that offers approximately 7.5–8% annual percentage yield (APY) through staking and maximum extractable value (MEV) rewards. With 0% validator commission and 100% MEV kickback to stakers, JupSOL allows users to earn yield on idle SOL while supporting Jupiter’s validator, which improves swap performance.

8. Jupiter Studio and Launchpad

Jupiter Studio is a token creation platform that empowers developers and projects to launch tokens on Solana. The Jupiter Launchpad supports new projects by facilitating token launches, pre-listing trading, and community-driven funding initiatives like Atlas, a public seed-funding program. These tools make Jupiter a hub for innovation, attracting new projects and boosting Solana’s ecosystem growth.

- Learn More: Jupiter Studio Solana MemeCoins Launchpad Review

The Role of JUP Token

The JUP token is the heart of Jupiter’s ecosystem, serving multiple purposes:

- Governance: JUP holders can vote on platform upgrades, liquidity programs, and token launches, ensuring community-driven development.

- Incentives: Users earn rewards for trading activity and participation in the platform.

- Fee Reductions: Holding JUP may unlock fee discounts, enhancing cost-effectiveness for frequent traders.

Since its launch in January 2024, JUP has seen significant price momentum, with a market cap reaching $1.3 billion by mid-2025. However, like all cryptocurrencies, JUP is subject to market volatility, and potential investors should conduct thorough research before investing.

How to Trade on Jupiter Exchange

Trading on Jupiter is straightforward, even for beginners. Follow these steps to get started:

- Connect a Solana-Compatible Wallet: Use wallets like Phantom, Solflare, or Ledger for secure transactions.

- Fund Your Wallet: Purchase SOL to cover transaction fees and fund your trades.

- Visit Jupiter Exchange: Go to the official Jupiter website (jup.ag) and click “Connect Wallet.”

- Select Tokens: Choose the token pair you want to swap (e.g., SOL to USDC).

- Review Trade Routes: Jupiter displays the best routes, including price impact and minimum received tokens.

- Set Slippage: Adjust slippage settings to protect against market fluctuations.

- Confirm Swap: Approve the transaction in your wallet and complete the swap.

Jupiter’s transparent fee structure ensures users only pay standard network and exchange fees, with no additional protocol fees.

Jupiter’s Impact on the Solana Ecosystem

Jupiter has become Solana’s commercial core, driving liquidity and user engagement. With over 196,000 unique active wallets and 24-hour trading volumes exceeding $1 billion, Jupiter is the top DEX aggregator across all blockchains, surpassing competitors like Uniswap and Raydium. Its dominance is fueled by:

- High Throughput: Solana’s ability to process thousands of transactions per second enables Jupiter to handle large trade volumes efficiently.

- Low Fees: Jupiter’s trades are up to 40% cheaper than Ethereum-based DEXs, thanks to Solana’s low gas fees.

- Ecosystem Integration: Partnerships with major platforms like Binance, Gate.io, and MetaMask leverage Jupiter’s API for seamless trading.

Recent acquisitions, including SolanaFM, Coinhall, SonarWatch, Ultimate Wallet, and Moonshot, demonstrate Jupiter’s ambition to consolidate data, analytics, and user interfaces under one platform. The Jupnet cross-chain testnet and Juno routing upgrades further enhance its capabilities, positioning Jupiter as a full-stack DeFi solution.

Risks and Challenges

While Jupiter offers significant advantages, it’s not without risks:

- Market Volatility: Cryptocurrency prices, including JUP, are highly volatile.

- Competition: Other Solana-based DEXs like Kamino, Titan, and Drift are vying for market share.

- Token Unlocks: Upcoming token unlocks could impact JUP’s price stability.

- Governance Transparency: The Jupiter team has faced criticism over compensation and governance transparency, though efforts are underway to address these concerns.

Users should always conduct their own research and consider consulting a financial advisor before engaging in DeFi activities.

Why Jupiter is a Game-Changer for Solana

Jupiter’s evolution from a swap engine to a DeFi super-app underscores its transformative impact on Solana. By offering a one-stop platform for swaps, perpetuals, lending, and token launches, Jupiter caters to a wide range of users, from retail traders to developers. Its mobile-native trading app and integrations with platforms like MetaMask make DeFi accessible to “normal people,” driving mainstream adoption.

Community sentiment highlights Jupiter’s significance. Traders praise its low fees, fast execution, and innovative features like limit orders that “actually work.” The platform’s ability to ship new products rapidly — such as Jupiter Studio and the Lend feature — demonstrates its commitment to staying ahead in the competitive DeFi landscape.

Conclusion

Jupiter Exchange is more than just a DEX aggregator; it’s the backbone of Solana’s DeFi ecosystem. With its smart routing, advanced features, and community-driven governance, Jupiter offers unmatched liquidity, speed, and affordability. Whether you’re a seasoned trader or a DeFi newcomer, Jupiter provides the tools to navigate Solana’s vibrant ecosystem with confidence.

Ready to explore Jupiter Exchange? Visit jup.ag to start trading, stake JupSOL for yield, or participate in governance to shape the future of DeFi on Solana. Always do your own research and trade responsibly.