HumidiFi Solana WET: Revolutionizing Liquidity in DeFi’s Fastest Ecosystem

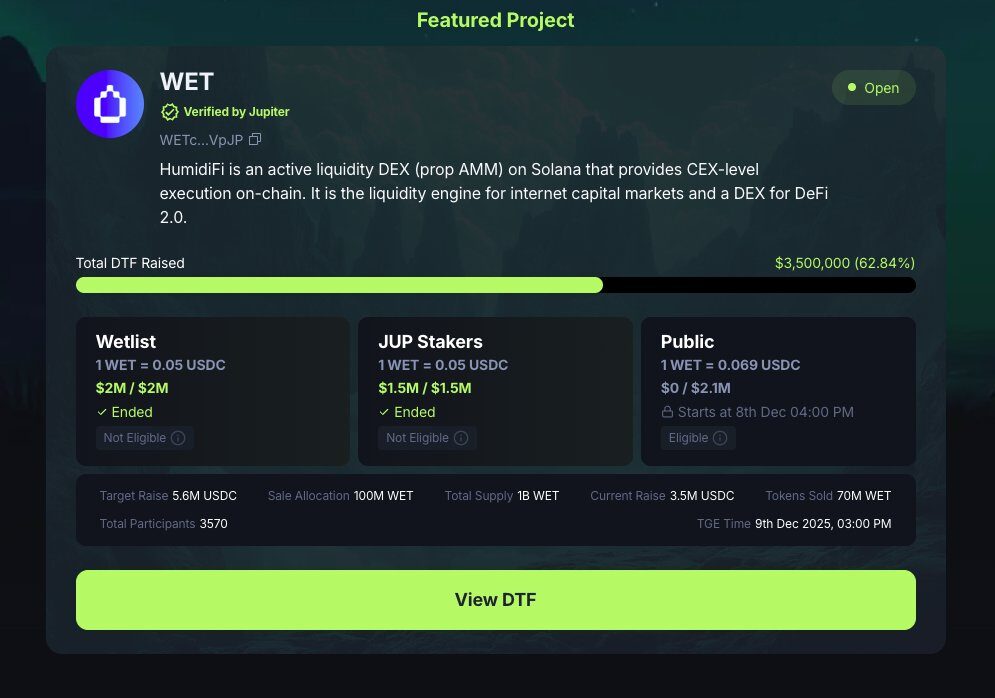

HumidiFi Solana WET stands at the forefront of decentralized finance innovation, powering over 35% of Solana’s daily DEX volume with its proprietary automated market maker (prop AMM) model. Launched in mid-2025, this protocol has quietly transformed how traders execute large swaps on-chain, blending institutional-grade efficiency with Solana’s unmatched speed. As the native token $WET prepares for its public relaunch today via Jupiter’s Decentralized Token Formation (DTF) platform, the buzz around HumidiFi Solana WET underscores a shift toward active liquidity management that minimizes slippage and shields against predatory bots.

What makes HumidiFi Solana WET more than just another token? It’s the engine behind billions in trades, delivering sub-second settlements and spreads tighter than many centralized exchanges. For traders tired of front-running and poor execution, this protocol offers a “dark pool” alternative on Solana—private, precise, and profoundly scalable.

What Is HumidiFi? The Prop AMM Redefining Solana DEX Trading

At its core, HumidiFi Solana WET operates as a prop AMM, or proprietary automated market maker, designed exclusively for Solana’s high-throughput blockchain. Unlike traditional AMMs like Raydium or Orca, which rely on public liquidity pools vulnerable to impermanent loss and MEV (miner extractable value) attacks, HumidiFi uses internal, algorithm-driven liquidity vaults.

These vaults actively predict price movements using off-chain oracles, aggregate depth from multiple sources, and execute trades atomically. The result? A platform that handles $1 billion+ in daily volume with just $5-10 million in TVL, achieving capital efficiency ratios up to 100x higher than competitors. Traders report slippage under 0.1% on $10 million swaps—levels that rival Binance or Coinbase, but without custody risks.

HumidiFi’s rise wasn’t accidental. Since its May 2025 debut, it has captured roughly one-third of Solana’s spot DEX activity, processing nearly $125 billion cumulatively by early December. This dominance stems from seamless integration with Jupiter, Solana’s leading swap aggregator, routing trades through HumidiFi for optimal pricing. For Solana users, it’s become the go-to for everything from meme coins like WIF to stablecoin pairs, proving that HumidiFi Solana WET isn’t hype—it’s infrastructure.

The $WET Token: Governance, Rebates, and Incentives in Action

$WET, the governance and utility token for HumidiFi Solana WET, isn’t just a speculative asset; it’s the key to unlocking protocol rewards. With a fixed total supply of 1 billion tokens, $WET enables staking for tiered trading rebates—up to 50% of fees returned based on stake size—while empowering holders to vote on liquidity parameters and fee structures.

Tokenomics break down transparently:

| Allocation Category | Percentage | Initial Unlock at TGE | Vesting Schedule |

|---|---|---|---|

| ICO/Public Sale | 10% | 100% | Immediate |

| Foundation | 40% | 8% | 2-year linear |

| Ecosystem & Incentives | 25% | 5% | 2-year staged |

| Team & Labs | 25% | 0% | 2-year cliff + linear |

This structure prioritizes community access, with no private VC rounds—VCs must buy on DTF or open market, aligning incentives for long-term growth. Fees from HumidiFi’s 0.05-0.25% taker rates (50% to LPs, rest to treasury) flow back via $WET staking, creating a flywheel: more volume means richer rebates, drawing deeper liquidity.

Early adopters see $WET as a bet on Solana’s DeFi maturity. At today’s public sale price of $0.069 per token (69M FDV), it undervalues a protocol already generating $7M+ in monthly fees. Analysts project $0.34-$0.64 by mid-2026 if volume holds, driven by listings on Meteora and potential Binance Alpha integration.

How to Buy $WET in the HumidiFi Solana Public Sale: Step-by-Step Guide

Participating in the HumidiFi Solana WET sale demands preparation, especially with first-come, first-served mechanics and bot countermeasures in place. The relaunch today at 10 AM ET (3 PM UTC) allocates 30 million tokens (3% of supply) at $0.069 USDC each, capped at 500 USDC per wallet.

Here’s how to join:

- Set Up Your Solana Wallet: Use Phantom or Backpack. Ensure you have at least 1 SOL for gas and 500+ USDC ready. Bridge funds via Wormhole if needed.

- Access Jupiter DTF: Head to dtf.jup.ag/launch/wet. Connect your wallet and approve permissions.

- Check Eligibility: JUP stakers get priority in earlier phases; public buyers enter the queue at launch. Monitor for your slot—expect it to fill in minutes.

- Commit and Confirm: Input your USDC amount (up to cap), review pricing, and sign the on-chain transaction. Tokens claimable tomorrow at 9 AM ET, with liquidity live on HumidiFi and Meteora.

Pro tip: Test a small swap on Jupiter beforehand to verify setup. Past sales sold out in seconds due to Sybil attacks, but today’s lowered caps and anti-bot filters level the field for genuine users.

Why HumidiFi Solana WET Outshines Traditional Solana DEXs

Solana’s DEX landscape is crowded, but HumidiFi Solana WET carves a niche through execution superiority. Compare it side-by-side:

| Feature | HumidiFi ($WET) | Raydium/Orca (Traditional AMM) |

|---|---|---|

| Daily Volume Share | 35%+ of Solana DEX | 20-25% |

| Slippage on $1M Swap | <0.1% | 0.5-2% |

| MEV Protection | Built-in dark pool routing | Relies on user-side tools |

| Capital Efficiency | 100x (low TVL, high output) | 10-20x |

| Fees | 0.05-0.25%, rebates via $WET | 0.25%, no native rebates |

This edge comes from prop logic: algorithms hedge inventory off-chain while settling on Solana, dodging the pitfalls of constant product formulas. For whales moving SOL-USDT or emerging tokens like ORE, HumidiFi delivers CEX-like reliability without off-ramps.

Community feedback echoes this. Traders highlight seamless $10M+ executions during volatile pumps, where other DEXs falter. Liquidity providers earn 2-5x yields with near-zero impermanent loss, turning passive holding into active income.

Risks and Realities: Navigating Volatility in HumidiFi Solana WET

No DeFi play is risk-free, and HumidiFi Solana WET faces hurdles. Centralization concerns linger—90% of tokens vest to team and foundation, potentially delaying full decentralization. Ultra-low fees (as little as 0.001%) raise sustainability questions: can $7M monthly revenue cover arbitrage and oracle costs long-term?

Market risks amplify this. Solana’s ecosystem thrives on hype, but a broader crypto downturn could slash volumes. Regulatory scrutiny on “dark pools” might evolve, though Solana’s speed positions HumidiFi as compliant by design. Bot interference plagued the initial sale, but today’s safeguards—dynamic caps and queue randomization—mitigate repeats.

Mitigate by diversifying: Stake $WET for rebates rather than pure speculation, and pair with SOL holdings for ecosystem exposure. DYOR remains paramount; past performance, like HumidiFi’s 50% volume spike in November, doesn’t guarantee future pumps.

The Future of Liquidity: Where HumidiFi Solana WET Leads Solana DeFi

Looking ahead, HumidiFi Solana WET could anchor Solana’s next DeFi wave. With $WET enabling governance over new pools—like tokenized real-world assets or cross-chain bridges— the protocol eyes 50%+ market share by 2026. Integrations with Drift for perps or Base bridges for hybrid liquidity hint at multi-chain expansion, while $WET’s rebate model incentivizes viral adoption.

In a space where execution trumps yields, HumidiFi proves liquidity isn’t static—it’s strategic. As Solana scales to millions of users, $WET holders stand to benefit from the network’s compounding momentum. Whether you’re a day trader dodging slippage or a long-term builder stacking infrastructure, HumidiFi Solana WET offers a wet, wild entry into DeFi’s evolving frontier. Dive in prepared, and watch the flows reshape on-chain markets.