Photon Sol Best Settings and Fees: Slippage, Priority Fee, and Bribe Fee

Photon Sol is a decentralized trading platform built on the Solana blockchain, designed to provide users with a fast and efficient way to trade tokens, particularly meme coins. Developed by TinyAstro, it offers a competitive edge through features like one-click trading, real-time token data (e.g., creation time, liquidity, and market capitalization), and customizable settings for optimizing trades. Its speed rivals Telegram-based trading bots like Trojan, but with a more intuitive web-based interface, making it a popular choice for traders seeking to capitalize on Solana’s high-throughput, low-cost blockchain.

This guide explores the fee structure of Photon Sol and provides recommendations for optimizing slippage, priority fee, and bribe fee settings to enhance your trading experience. By understanding these components, you can maximize profits and minimize failed transactions, even in volatile markets.

Understanding Fees on Photon Sol

To trade effectively on Photon Sol, it’s essential to understand the platform’s fee structure and how different settings impact your transactions. Below is a detailed breakdown of the key fee components and their roles.

a. Base Fees

Photon Sol charges a 1% fee on every buy and sell transaction, collected in SOL and calculated based on the initial token amount used. This fee is standard across many Solana-based trading bots and platforms.

- Example (Buy Transaction): If you spend 5 SOL to buy tokens, the fee is 0.05 SOL (1% of 5 SOL), leaving 4.95 SOL for the purchase.

- Example (Sell Transaction): If you sell tokens worth 1 SOL, the fee is 0.01 SOL (1% of 1 SOL), and you receive 0.99 SOL after the fee.

This fee is separate from Solana’s network fees and is specific to Photon Sol’s platform operations.

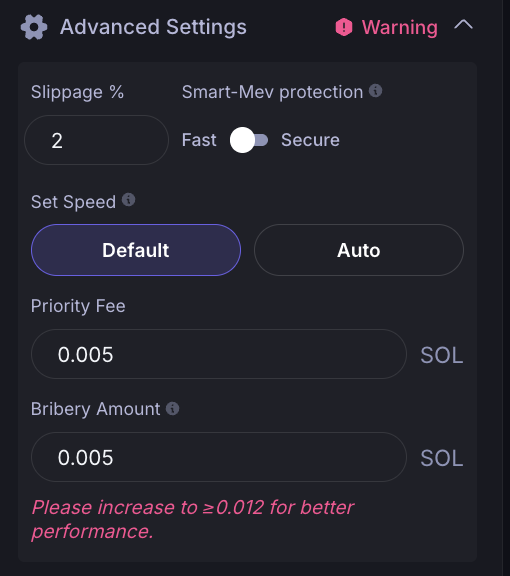

b. Priority Fees

Priority fees are optional fees paid to Solana validators to prioritize your transaction in the network’s transaction queue. Solana’s fee system includes a base fee of 0.000005 SOL (5,000 lamports) per signature, but priority fees allow you to increase the likelihood of faster processing by offering an additional tip to validators.

- On Photon Sol, users can set the priority fee in the platform’s settings menu.

- Higher priority fees are particularly useful during periods of high network congestion, such as when trading newly launched or highly volatile tokens.

- Typical Range: 0.005–0.01 SOL, though this may need to increase during peak activity.

c. Bribe Fees

Bribe fees are an additional layer of incentivization, specifically directed to JITO validators, a subset of Solana validators that optimize transaction processing. These fees encourage JITO validators to prioritize your transaction, further reducing confirmation times.

- Like priority fees, bribe fees are optional and can be adjusted in Photon Sol’s settings.

- Typical Range: 0.001–0.005 SOL, with adjustments based on network demand.

- Bribe fees are particularly relevant for traders aiming to snipe new tokens or execute trades in fast-moving markets.

d. Slippage

Slippage refers to the difference between the expected price of a trade and the price at which it is executed. In decentralized exchanges like Photon Sol, slippage occurs due to the nature of liquidity pools, where large trades or rapid price movements can shift the token’s price during execution.

- Negative Slippage: Occurs when you buy at a higher price or sell at a lower price than expected, reducing your profit.

- Positive Slippage: Occurs when you buy at a lower price or sell at a higher price than expected, increasing your profit.

- Users can set a slippage tolerance in Photon Sol’s settings to allow for price fluctuations. For example, a 5% slippage tolerance means the trade will execute if the price moves by up to 5% from the expected price.

- Typical Range: 5%–30%, depending on the token’s volatility and market conditions.

Additional Considerations

- SPL Token Activation: When trading a new token, Photon Sol may temporarily activate the SPL token on your wallet, incurring a small fee (redeemed upon selling).

- Smart-MEV Protection: Photon Sol offers features to protect against Maximal Extractable Value (MEV) attacks, such as sandwich attacks, which may influence fee settings.

- Failed Transactions: Some users report failed trades due to insufficient wallet balance to cover fees or improper settings. Always ensure your wallet has enough SOL to cover base fees, priority fees, bribe fees, and network costs.

| Fee Type | Description | Typical Range | Notes |

|---|---|---|---|

| Base Fee | 1% of the transaction amount, collected in SOL | 1% of trade value | Applied to every buy/sell transaction |

| Priority Fee | Optional fee to prioritize transaction processing | 0.005–0.01 SOL | Adjust based on network congestion |

| Bribe Fee | Optional fee to incentivize JITO validators | 0.001–0.005 SOL | Useful for sniping or fast markets |

| Slippage | Allowable price fluctuation for trade execution | 5%–30% | Higher for volatile tokens, lower for stable ones |

Best Settings for Slippage, Priority Fee, and Bribe Fee

The optimal settings for slippage, priority fee, and bribe fee depend on the token being traded, market conditions, and Solana network activity. Based on user experiences and platform documentation, here are recommended settings and considerations:

Slippage

- Volatile Tokens (e.g., Meme Coins): Set slippage between 15% and 30% to ensure trades execute in fast-moving markets. For example, during a token launch or pump, prices can change rapidly, and a higher slippage tolerance prevents failed transactions.

- Stable Tokens: For tokens with lower volatility, a slippage of 5%–10% is often sufficient.

- Risk Consideration: Higher slippage increases the chance of trade execution but may result in less favorable prices. Test with small trades to find the right balance.

Priority Fee

- Standard Setting: A priority fee of 0.005–0.01 SOL is commonly used for most trades.

- High Congestion: During periods of high network activity (e.g., major token launches), increase to 0.01 SOL or higher to ensure faster processing.

- Monitoring: Check Solana network status via tools like Solanacompass to gauge congestion and adjust fees accordingly.

Bribe Fee

- Standard Setting: A bribe fee of 0.001–0.005 SOL is typical for most trades.

- Fast Markets: For sniping new tokens or trading during pumps, increase to 0.005 SOL or more to incentivize JITO validators.

- Cost-Benefit: Bribe fees add to transaction costs, so weigh their necessity against potential profits, especially for small trades.

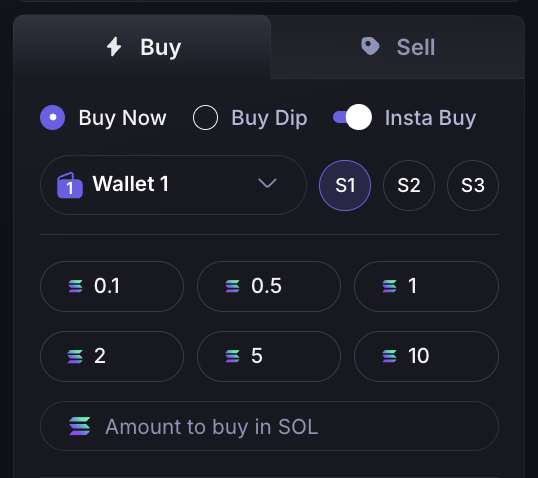

Using Trading Presets

Photon Sol allows users to save up to three trading presets (S1, S2, S3), enabling quick switching between different combinations of slippage, priority fee, and bribe fee settings. This is particularly useful for adapting to varying market conditions.

- Example Presets:

- S1 (Low-Risk): 5% slippage, Juno, 0.005 SOL priority fee, 0.001 SOL bribe fee (for stable tokens).

- S2 (Balanced): 15% slippage, 0.007 SOL priority fee, 0.003 SOL bribe fee (for moderately volatile tokens).

- S3 (High-Risk): 25% slippage, 0.01 SOL priority fee, 0.005 SOL bribe fee (for meme coins or launches).

| Preset | Slippage | Priority Fee | Bribe Fee | Use Case |

|---|---|---|---|---|

| S1 | 5% | 0.005 SOL | 0.001 SOL | Stable tokens, low volatility |

| S2 | 15% | 0.007 SOL | 0.003 SOL | Moderate volatility, balanced trading |

| S3 | 25% | 0.01 SOL | 0.005 SOL | High volatility, meme coins, sniping |

User Experiences

Some traders report challenges with high fees or failed transactions, often due to insufficient SOL for fees or overly conservative settings. For example:

- A trader using 15% slippage, 0.005 SOL priority fee, and 0.001 SOL bribe fee reported a loss despite a 50% profit due to high fees on a small 0.15 SOL trade.

- Another user set 100% slippage, 0.025 SOL priority fee, and 0.05 SOL bribe fee but couldn’t sell due to insufficient balance, highlighting the need for adequate SOL reserves.

To avoid such issues, ensure your wallet has enough SOL to cover all fees and adjust settings dynamically based on market conditions.

Tips for Optimizing Trades on Photon Sol

To maximize your success on Photon Sol, consider the following strategies:

- Monitor Network Conditions:

- Use tools like Solanacompass to track Solana’s network activity. Increase priority and bribe fees during congestion to ensure timely transaction processing.

- Leverage Filters:

- Photon Sol offers filters to identify legitimate tokens by checking liquidity provider (LP) status, mint authority, and other metrics. Use these to avoid rug pulls and scams, especially with new tokens.

- Test with Small Amounts:

- If you’re new to Photon Sol, start with small trades (e.g., 0.1–0.5 SOL) to test settings and understand their impact on trade outcomes.

- Stay Informed:

- Follow updates from Photon Sol’s official documentation and the Solana community to stay aware of platform changes, new features, and best practices.

- Adjust Settings Dynamically:

- Be prepared to tweak slippage, priority, and bribe fees based on token volatility and network conditions. For example, increase slippage to 25%–30% for fast-moving meme coins.

- Use Quick Buy/Sell Features:

- Photon Sol’s one-click trading feature simplifies rapid trades, but ensure your settings are optimized to avoid unexpected costs.

- Maintain Sufficient Balance:

- Always keep extra SOL in your wallet to cover base fees, priority fees, bribe fees, and potential SPL token activation costs to prevent failed transactions.

Conclusion

Trading on Photon Sol can be highly rewarding with the right knowledge and settings. The platform’s 1% base fee, combined with adjustable priority fees, bribe fees, and slippage settings, allows traders to tailor their strategies to market conditions. Recommended settings include 15%–30% slippage, 0.005–0.01 SOL priority fee, and 0.001–0.005 SOL bribe fee, with adjustments for volatility and network congestion. By using trading presets, monitoring network activity, and leveraging Photon Sol’s filters, traders can enhance their efficiency and profitability.

However, some users report challenges with high fees or failed trades, often due to insufficient SOL or suboptimal settings. To mitigate these risks, test settings with small trades, maintain adequate wallet balances, and stay informed about Solana’s network dynamics. For further guidance, refer to Photon Sol’s official documentation and Solana’s fee guide.

Trading on Photon Sol requires a balance of speed, cost management, and risk awareness. With the right approach, you can capitalize on Solana’s high-speed, low-cost blockchain to achieve successful trades.