BullX NEO Best Settings and Fees: Slippage, Priority Fee, and Bribe Fee

BullX NEO is a powerful multi-chain decentralized exchange (DEX) trading platform, particularly popular among traders of Solana-based memecoins. Its features, including real-time charts, limit orders, multi-wallet management, and Telegram integration, make it a versatile tool for both novice and experienced traders. However, to maximize profitability and efficiency, understanding the platform’s fee structure and optimizing trading settings are essential. This comprehensive guide explores BullX NEO’s fees, including the platform fee, protocol fees, and Solana transaction fees, and provides detailed recommendations for configuring slippage, priority fee, and bribe fee settings to enhance your trading strategy.

BULLX NEO official Telegram Bot

https://t.me/BullXNeoBot

Use the BullX NEO code “start=access_HWNG75IY62” to possibly reduce trading fees by 10%, offering an efficient way to begin trading.

Fee Structure

BullX Platform Fee

BullX NEO charges a 1% fee on every transaction, applied to both buy and sell orders and collected in SOL. This fee is straightforward and predictable, making it easy to incorporate into your trading calculations. For example:

- Buy Example: If you spend 5 SOL to purchase tokens, a 0.05 SOL fee is deducted, leaving 4.95 SOL for the trade.

- Sell Example: If you sell tokens worth 1 SOL, a 0.01 SOL fee is deducted, resulting in a net of 0.99 SOL.

This fee supports the platform’s operations, ensuring fast indexing and reliable trading features.

Protocol Fees

In addition to the BullX fee, traders incur protocol fees that vary depending on the liquidity protocol or pool used. These fees typically range from 0.15% to 5%, depending on the specific protocol. Common examples include:

- PumpFun Tokens: Typically incur a 1% protocol fee.

- Raydium Pools: Often charge a 0.25% fee for PumpFun tokens.

- Other Protocols: Some pools may have fees as high as 5%, so it’s critical to check the specific protocol’s documentation for precise details.

These fees are mandatory and cannot be adjusted, so traders should factor them into their cost calculations, especially for frequent or small trades.

Solana Transaction Fees

Trading on BullX NEO also involves standard Solana network fees, which include:

- Priority Fee: An additional payment to Solana validators to prioritize your transaction, particularly during network congestion. The default priority fee is 0.01 SOL, but users can adjust it manually or select presets like “Rapid” (moderate fee) or “Insane” (higher fee) for faster confirmations.

- Bribe Fee: An incentive paid to validators or the Jito network to further prioritize your transaction. The default bribe fee is 0.01 SOL, with an additional 0.002 SOL automatically added in MEV Only Mode for enhanced reliability.

MEV Only Mode

Maximal Extractable Value (MEV) refers to the profit validators can gain by reordering transactions in a block. Enabling MEV Only Mode routes transactions through the Jito network, reducing risks like sandwich attacks, where bots front-run or back-run your trades. In this mode, BullX NEO may add a static 0.002 SOL to the bribe fee to ensure transaction reliability, particularly during high network activity. This mode is recommended for traders prioritizing security over minimal cost savings.

| Fee Type | Details |

|---|---|

| BullX Fee | 1% of transaction amount, collected in SOL for buys and sells. |

| Protocol Fees | 0.15% to 5% depending on protocol (e.g., PumpFun: 1%, Raydium: 0.25%). |

| Priority Fee | Default: 0.01 SOL; adjustable with presets (Rapid, Insane) or custom values. |

| Bribe Fee | Default: 0.01 SOL; +0.002 SOL in MEV Only Mode for reliability. |

Best Settings for Trading on BullX NEO

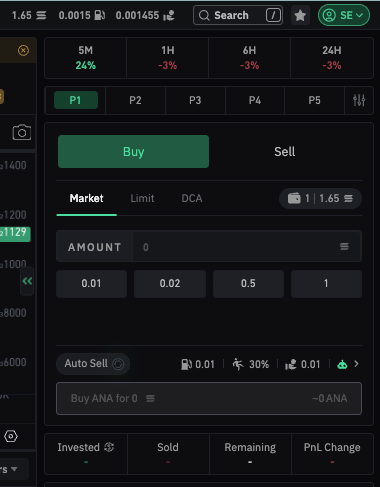

Optimizing your trading settings on BullX NEO is crucial for balancing speed, cost, and reliability. Below are detailed recommendations for slippage, priority fee, and bribe fee, incorporating insights from official documentation and community feedback.

Slippage

Slippage is the difference between the expected price of a trade and the actual executed price, often significant in volatile memecoin markets. Setting an appropriate slippage tolerance is key to ensuring trades execute without excessive price deviations.

- Recommended Slippage Settings: For most trades, a slippage tolerance of 1-5% is advised to balance execution reliability with price protection. For highly volatile or low-liquidity tokens, increasing to 5-10% may be necessary to ensure trades go through, though this increases the risk of unfavorable prices.

- Community Insights: Some traders suggest a 10-20% slippage limit for new or low-volume tokens to account for rapid price swings. Experimenting with slippage settings can help save SOL, especially for smaller trades.

Priority Fee

The priority fee incentivizes Solana validators to process your transaction faster, which is critical in fast-moving markets like memecoins.

- Recommended Priority Fee Settings: The default 0.01 SOL is suitable for standard conditions. However, during high network congestion or when chasing price pumps, increasing to 0.015-0.02 SOL can ensure faster execution. Starting at 0.015 SOL and adjusting based on market activity is a practical approach.

- Presets: BullX NEO offers presets like “Rapid” (moderate fee) and “Insane” (higher fee), which are useful for time-sensitive trades. Setting the priority fee to 0 is possible but not recommended, as it may lead to slower or failed transactions.

Bribe Fee

The bribe fee further prioritizes your transaction, particularly in MEV Only Mode, by incentivizing validators or the Jito network.

- Recommended Bribe Fee Settings: The default 0.01 SOL is generally sufficient for most trades. For enhanced MEV protection or during competitive trading scenarios, consider increasing to 0.01-0.015 SOL. In MEV Only Mode, an additional 0.002 SOL may be added automatically for reliability.

- Community Insights: For low-volume tokens, some traders recommend a lower bribe fee, such as 0.0015 SOL, to save costs without compromising execution. Avoid overpaying by matching unnecessarily high recommended bribe fees unless trading high-value or volatile tokens.

| Setting | Recommended Value | Notes |

|---|---|---|

| Slippage | 1-5% (5-10% for volatile tokens) | Increase to 10-20% for new/low-volume tokens; adjust based on volatility. |

| Priority Fee | 0.015-0.02 SOL (default: 0.01 SOL) | Use higher fees (e.g., Rapid/Insane presets) during congestion. |

| Bribe Fee | 0.01-0.015 SOL (default: 0.01 SOL) | Lower to 0.0015 SOL for low-volume tokens; enable MEV Only Mode for safety. |

Additional Tips for Optimizing Trades

To further enhance your trading performance on BullX NEO, consider the following strategies:

- Trade Size: Fees can significantly erode profits on small trades. For example, trading with 0.2 SOL may yield minimal returns after fees. Using larger trade sizes, such as 1 SOL or more, can improve percentage gains and make fees less impactful.

- MEV Protection: Always enable MEV Only Mode to protect against front-running and sandwich attacks, especially for larger or high-stakes trades.

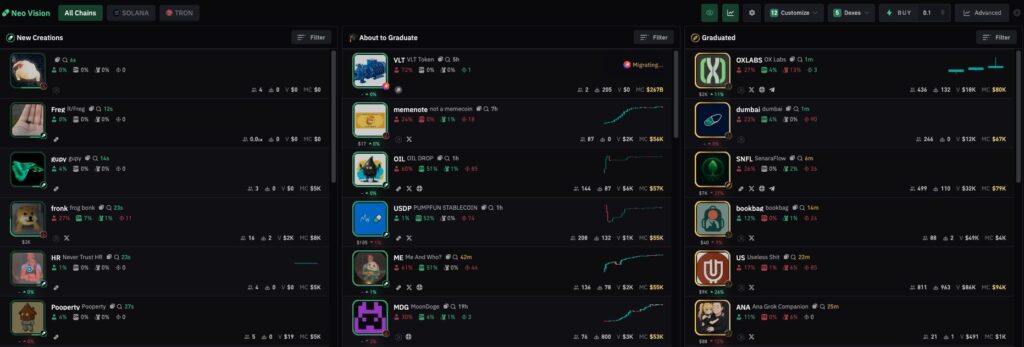

- Filters and Risk Management: BullX NEO’s filtering tools help identify safer, high-potential tokens. Some experienced traders recommend the following filter settings for new token creations:

- Holders: 400 minimum

- Insiders: 4% maximum

- Snipers: 7 maximum

- Volume: $400k minimum

- Market Cap: $65k minimum For lower-risk strategies, consider stricter filters:

- Holders: 50 minimum

- Insiders: 5% maximum

- Snipers: 7 maximum

- 24H Volume: $40k minimum

- Market Cap: $50k minimum

- Liquidity: $25k minimum

- Dev Supply: 20% maximum

- Additional Checks: Liquidity burned, Mint Authority disabled, at least one social media presence. These filters help screen out potential rug pulls and focus on tokens with strong community support and market activity.

- Holders Data Upgrade: Utilize BullX NEO’s Holders Data Upgrade feature to access critical metrics like the number of holders (e.g., 2360), top 10 holders’ percentage (e.g., 14%), bot users (e.g., 505), and insiders’ holding percentage (e.g., 1.8%). These insights can guide faster, more informed trading decisions.

- Experiment with Settings: Market conditions and token liquidity vary, so experiment with slippage, priority, and bribe fee settings to find the optimal balance for your trading style. For example, lower fees may suffice for slower, low-volume trades, while higher fees are justified for competitive, high-volume markets.

- Monitor Network Congestion: Check BullX NEO’s interface for recommended gas fees, typically displayed in the top-right corner. Matching the priority fee to these recommendations can ensure timely execution, but be cautious with bribe fees, as they may be higher than necessary.

- Axiom Trade Settings

Community Insights and Alternatives

Community discussions highlight the importance of tailoring settings to specific trading scenarios. For instance, traders note that small trades (e.g., 0.2 SOL) are less profitable due to fixed fees, and suggest alternatives like Photon, which may offer lower fees for similar functionality. Other platforms, such as Axiom (0.7% fees) and Nova bot, provide additional tools like Twitter tracking or copy trading, but BullX NEO remains a top choice for its speed and analytics.

Some traders emphasize the importance of not investing in every token but focusing on high-potential opportunities identified through filters and market data. Tools like the “Neo Vision” feature, which analyzes coin data in real-time, can help traders skip risky tokens and focus on promising runners.

Conclusion

BullX NEO is a robust platform for trading Solana memecoins, but its fees and settings require careful consideration to maximize profitability. The 1% platform fee, combined with protocol fees (0.15%-5%) and Solana transaction fees (priority and bribe, defaulting to 0.01 SOL each), can add up, particularly for small trades. By setting slippage to 1-5% (or 5-20% for volatile tokens), priority fees to 0.015-0.02 SOL, and bribe fees to 0.01-0.015 SOL (or lower for low-volume tokens), traders can balance speed, cost, and reliability. Additional strategies, such as using larger trade sizes, enabling MEV protection, and applying strict filters, can further enhance trading success.